New report puts Samsung ahead of Apple in US smartphone sales, with Motorola a distant third

Death, taxes, and Apple’s supremacy in the US smartphone market. Those three things may have seemed certain for a lot of people, but after you read the latest CIRP (Consumer Intelligence Research Partners) report, we’re not going to blame you if you start questioning your own mortality.

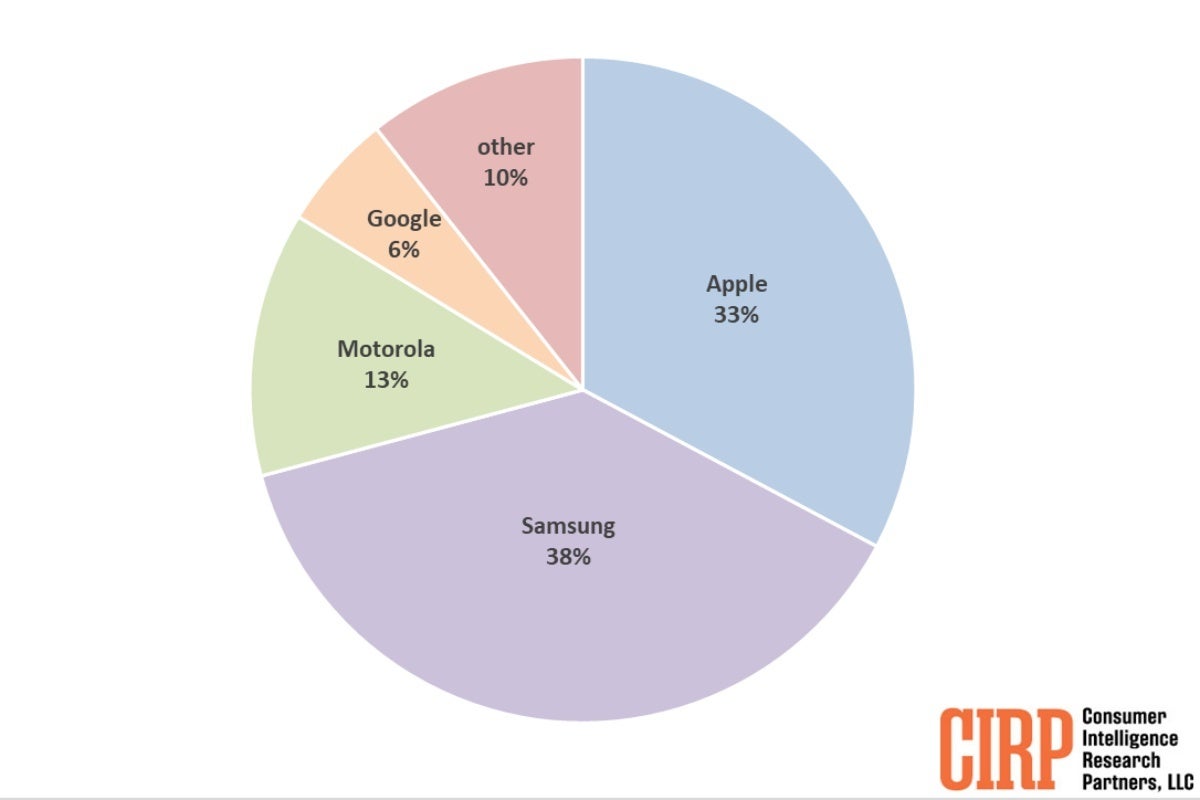

That’s because this analytics company actually believes Samsung outdid Apple in Cupertino’s own backyard in the 12-month period ending March 2024. The battle between the two was obviously pretty tight, but Galaxy devices ultimately came out on top with a 38 percent slice of the regional sales pie.

Apple’s iPhones held a 33 percent market share, which is definitely not a bad result per se. But it’s significantly poorer than what other research firms have estimated over the years, making us question, well, everything we thought we knew about the US mobile industry.

A Counterpoint Research report from just last month, for instance, ranked Apple well ahead of Samsung in Q1 2024 US smartphone shipments, and that’s been true for most previous quarters. In the absence of official sales data from the smartphone makers themselves, it’s difficult to know which of these third-party analysts to put our trust in.

Samsung is apparently the number one smartphone vendor in the US, followed by Apple and Motorola.

Assuming that today’s numbers are accurate, Apple can find solace in selling way more “flagships” than its arch-rival. The iPhone 15 and iPhone 14 families account for no less than 64 percent of the company’s total US handset sales between April 2023 and March 2024, with the Galaxy S23, S24, Z Fold, and Z Flip lines only making up 42 percent of Samsung’s regional tally in the same timeframe.

That means low to mid-end Galaxy phones are wildly popular stateside, which doesn’t exactly help Samsung generate Apple-level profit scores. Of course, profits aren’t everything, and sales volumes could lead to Samsung’s brand awareness becoming stronger and stronger in the long run in a key market like the US.

With 13 percent share, Motorola is clearly a very distant podium finisher in today’s smartphone vendor hierarchy, nonetheless beating Google pretty comfortably and showing promise for future progress. Like Samsung, this is a brand that thrives on selling feature-packed mid-rangers at competitive prices… while occasionally making waves with a very well-received flagship.